President’s Message

On behalf of BOU Bancorp Inc., (Company) the holding company of Bank of Utah (Bank) and Utah Risk Management, I am pleased to report a cash dividend paid in the first quarter of 2016 of $0.40 per share. At book value, the dividend yield is approximately 2.19 percent.

The Company has a long history of profitability. This consistent performance is not a result of chance or the by-product of a strong economy. Since the inception of the Bank in 1952, there have been ten recessions in the United States. Modernization of the banking industry has forced banks to become more efficient and has drastically reduced the number of surviving banks. In 1980, there were over 14,400 commercial banks across the country—today there are less than 5,400.

Our profitability and resilience is attributed to great customers, shareholders and a management team that leads with foresight. The Company continues to focus attention on asset quality and capital strength. Most importantly, the culture of the Company empowers all of its employees to take accountability for their job and the customer.

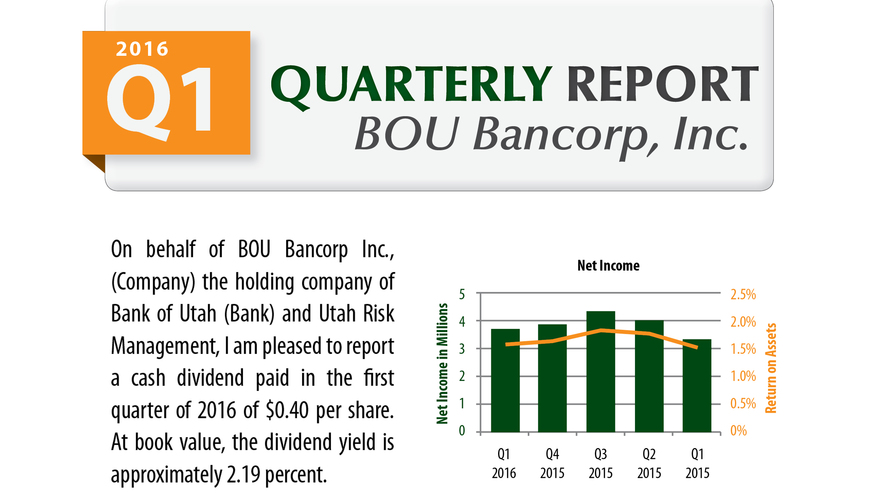

Net Income

In the first quarter of 2016, the net income was $3.70 million. This is an increase of approximately $400 thousand compared to the first quarter of 2015. This growth came from all areas of the Company. As shown in the graph above, net income for the past five quarters has been excellent. The Company’s return on assets of 1.55 percent and return on equity of 11 percent is strong, while the Company maintains a solid equity position of $136.5 million and 17.1 percent in total risk-based capital.

First Quarter Highlights

In the first quarter of 2016, the corporate trust department experienced a complete restructure, adding new emphasis on their established aircraft owner trust specialties and agency services for life settlements. In a short period of time, a highly skilled and experienced management team was put in place. They are supported by a qualified staff of knowledgeable employees with years of expertise. This change has proven to be highly beneficial as demonstrated by the department’s year-over-year increase in revenue for the quarter. First quarter revenue in 2016 was $1.5 million as compared to $1.4 million in the first quarter of 2015.

Further changes in the first quarter of 2016 include the introduction of a new web site and online banking product. The new features enable customers to find the products and tools they need to manage their finances, wherever they may be. Now, whether at a computer or on a phone, customers can apply for business or personal loans, open accounts, find wealth management services or handle virtually all of their deposit needs. Additionally, the improvements allow for person-to-person and bank-to-bank transfers. These are just a few of the many additional services available to our customers. I encourage you to visit us online at bankofutah.com and check out the new improvements.

The first quarter of 2016 is off to an excellent start. On behalf of the management team, we are appreciative of your continued support and trust.

Sincerely,

Douglas L. DeFries

Bank President and CEO

Company Vice President