Someone recently asked me, “What’s your worst grocery store habit?” Admittedly, one I’ve been guilty of is going to the supermarket hungry. It’s hard to bypass the snack aisles and the checkout stand goodies when my stomach is growling, and I end up buying items that look good but that I don’t really need.

Curious about other grocery store habits to avoid, I took a quick poll.

Here are some answers I got from family and friends:

- Not making a list/going to the store without a meal plan for the week

- Not checking to see what was already in the pantry at home

- Forgetting coupons at checkout

- Grabbing a cart when a basket would do (more room to put items that aren’t on your list … I had never thought of that!)

This topic first came up when I was chatting with friends about how stressful it is to go to the supermarket today. The shock when the cashier reads the total is real; the rising cost of food is a big burden and leaves people feeling overwhelmed, defeated and scared.

While we can’t control the price of groceries, we can control our habits. We can work to avoid the ones I just mentioned and add some good ones. Here are four habits to start with, to make your grocery bills more manageable.

4 Habits to Save Money at the Supermarket

1. Understand how much money you’re spending on groceries each month.

It’s easy to overspend at the grocery store. I’ve already mentioned some of the ways that can happen, but there are many others — from giving in to the delicious smells to grabbing the higher-priced name-brand items that are brightly displayed on end caps to buying those more-expensive pre-cut fruits and vegetables.

Tracking and reviewing your purchases is the first step to identifying your habits and discovering where you can cut back.

You can use your bank’s digital tools to get a quick, overall picture of your monthly grocery expenses.

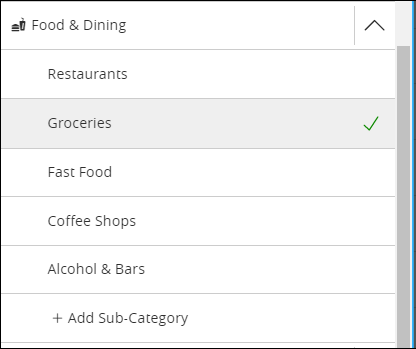

Bank of Utah’s Online Banking and Mobile App, for example, categorizes each of your transactions so you can go in and easily search for expenses that have been designated “Groceries.” Just be sure to check that the system is categorizing them correctly. Sometimes, it needs help being more specific. It may label your purchases as “Food & Dining” when it might be more helpful to separate out your grocery purchases and your fast food/restaurant expenses. Simply click on the transaction, then click “Category,” then change it to “Groceries.”

Reviewing your overall monthly grocery spending using online banking is a good habit to adopt, but you have to go a step further to see where you can spend more wisely. To do this, gather your receipts and, using a spreadsheet or paper, group your groceries into categories, such as meats, produce, dry goods, canned goods, snacks and drinks, etc. Then, tally up how much you spent on each group.

This will take some time, but it will be worth it because it will help you identify trends and save money. Perhaps you’re spending quite a bit on produce, for example. You might decide to stop buying pre-cut fruits and veggies for the convenience. Maybe you decide to stop buying produce from the store and start buying it from a local farmer’s market, where it’s fresher and often less expensive. (That’s one of my favorite things to do in the summer.)

2. Make a grocery budget.

Now that you have an idea of how much you’re spending, what you’re spending your money on, and what you can cut out or trim, you can make a grocery budget.

If you’re still not sure how much you should allocate to groceries each month, the U.S. Department of Agriculture publishes monthly food plans that can serve as a guideline for your monthly food budget. Four different cost levels are provided: thrifty, low, moderate and liberal. You can search for your family size to estimate your weekly and monthly food costs.

For example, the November 2024 thrifty food plan suggests that it costs approximately $983 a month to feed a family of four, including a male and a female, ages 20-50, and two children, ages 6-8 and 9-11. Remember, this is just an estimate. Your family may have special dietary requirements to consider that increase your costs, but it’s a good starting point that you can build from based on your needs.

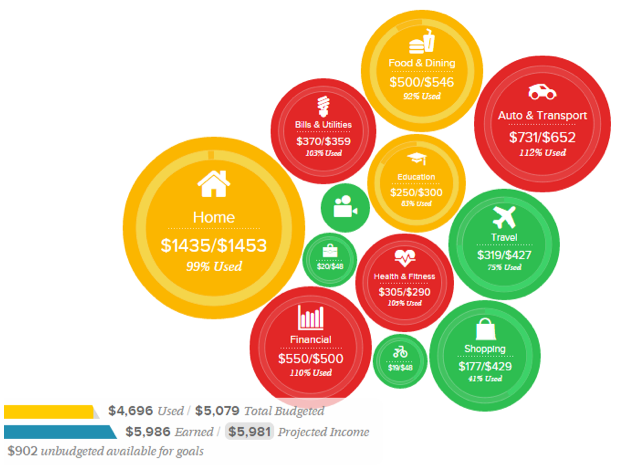

When you’re ready to create a budget, banking technology makes it easy. Using Bank of Utah’s budget tool in Online Banking and the Mobile App, you can create custom budgets, set spending limits and get visual cues to alert you to overspending. Just make sure you’ve labeled your transactions accordingly like I mentioned earlier because the budget tool draws from those categories.

3. Spend cash.

You’ve reviewed your grocery spending, identified areas where you can save, created a budget, and you’re ready to go grocery shopping. Quick tip, first make a list of everything you need, being sure to check your pantry. This way you don’t overspend by accidentally buying items you already have!

If you’re afraid you’ll be tempted to purchase things that will put you over budget, leave your card at home, head to the ATM and get cash to bring.

A cash-only grocery budget makes it to where you cannot overspend at the grocery store. You can only spend what you’ve brought. And I don’t know about you, but for me, it’s much harder mentally to physically hand over a $100 bill than it is to swipe my card. That can help you make better decisions, like swapping out that name brand case of soup for a store-brand so you keep within your cash budget.

4. Use a credit card — with care.

If using cash just doesn’t work for or appeal to you, I suggest using a credit card that earns points or rewards for grocery purchases. This way, you can put those rewards back toward your grocery budget, but you have to be very careful doing this.

These cards usually have a higher interest rate, or annual percentage rate (APR). Be sure you can pay off your balance in full every month, so you won’t incur interest.

Reward cards also may make it more enticing to spend, not just at the supermarket, but at other stores as well. Stick to all your household budgets, and don’t use points as a reason to overspend.

Finally, don’t forget to redeem your rewards — that’s what makes these cards beneficial! If you need help choosing a rewards card that works best for you, reach out to a banker. They can show you what cards they have available, and also help you understand the rewards system.

A Final Thought

I mentioned one of my bad grocery habits earlier (going to the store hungry), but I wanted to share one of my favorite good habits with you, one last tip to help you save: Use store pickup. Instead of going in after work and getting tempted to buy those items that sound and look good, I place the order and pick it up on the way home. No going in means no impulse purchases!

Times are challenging economically. If you need help budgeting or need more advice on how to cut back and save in any area of your life, please reach out. We can help you keep your financial goals on track.

Kim Lenhart is Banking Manager for Bank of Utah’s Logan branch.

Kim Lenhart is Banking Manager for Bank of Utah’s Logan branch.

Fun & Kid-Friendly Recipes to Stretch Your Grocery Budget

French Toast

PB & J Sandwiches

Stir Fry