PPP Update:

Due to unprecedented demand for the Small Business Administration’s (SBA) Paycheck Protection Program we are temporarily suspending the acceptance of new applications as we continue to work with the SBA to best support our customers. For businesses that have already submitted an application, we will continue to process these applications and will reach out to existing applicants directly with next steps. We will continue to monitor federal relief updates and may re-open our application process when we are able.

CARES COVID-19 Relief

In an effort to address the economic impact of the COVID-19 virus, the Federal Government has enacted the Coronavirus Aid, Relief and Economic Security (CARES) Act. CARES is a $2 trillion stimulus package to provide relief to American consumers and businesses struggling as a result of the Coronavirus pandemic.

One component of the CARES Act is the Paycheck Protection Program (PPP). The PPP is a loan designed to help small businesses affected by Coronavirus/COVID-19 keep their workers on the payroll. We are encouraging all our small business borrowers who are impacted by COVID-19 to consider applying for a loan under this new program, which provides some critical benefits, including:

- Cash to cover select business expenses (such as employee salaries and payroll support, rent or mortgage and utilities payments, insurance premiums)

- 6 months of deferred loan payments

- Loan forgiveness (a portion, or possibly all, of your loan may be forgiven)

Key Points to Know:

- Length of a PPP loan: 2 years

- Interest rate on a PPP loan: 1%

- Maximum dollar amount of a PPP loan: 2.5x of your average total monthly payments for payroll costs of the business during the 1-year period before the loan is made. Payroll costs include salary, wage, vacation, parental, family, medical or sick leave, severance, health care benefits, and local taxes.

- Last day to apply for a PPP loan: June 30, 2020

In efforts to serve our local communities, Bank of Utah will only accept PPP applications from businesses within the State of Utah and Southeast Idaho. Additionally, we will accept applications from our current customers regardless of their location.

Quick Links:

PPP Loan Application | PPP FAQs | SBA Disaster Loans | Utah Leads Together Small Business Bridge Loans

What you need to know about the PPP program

Are you eligible?

You are eligible if you are:

- A small business with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- A 501(c)(3) with fewer than 500 employees

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- A 501(c)(19) Veterans Organization that meets the SBA size standard

In addition, some special rules may make you eligible:

- If you are in the accommodation and food services sector (NAICS 72), the 500-employee rule is applied on a per physical location basis

- If you are operating as a franchise or receive financial assistance from an approved Small Business Investment Company the normal affiliation rules do not apply

REMEMBER: The 500-employee threshold includes all employees; full-time, part-time, and any other status.

Due to the volume of applications, it may take several days before we contact you. A bank representative will reach out to you when it is time to process your application.

We encourage you to consult your accountant to complete your documentation.

Required Documentation:

To expedite your application, the following items need to be included. (If you have submitted this information recently on a previous loan, contact your relationship manager to determine if it needs to be resubmitted.)

Businesses with employees:

- Completed application

- Copy of identification (Driver’s License) for all signers, control persons and individual owners with over 20% ownership

- Copy of articles and operating agreement or bylaws

- Verify business registration with state of Utah

- Date of birth, address and Social Security Number for beneficial owners over 20% and control persons

- Most recently filed business tax return including K-1’s

- Payroll information for 2019 including 941’s and payroll detail per employee

- The above items are subject to change depending upon guidance from the SBA

Sole proprietors, S-Corps, independent contractors and partnerships:

- Completed application

- 2019 Schedule C, if appropriate

- 2019 Schedule E, if appropriate

- 1099's for 12 months ending 12/31/2019

- K-1's for 12 months ending 12/31/2019

- Company financial statements for 12 months ending 12/31/2019

How much can you borrow

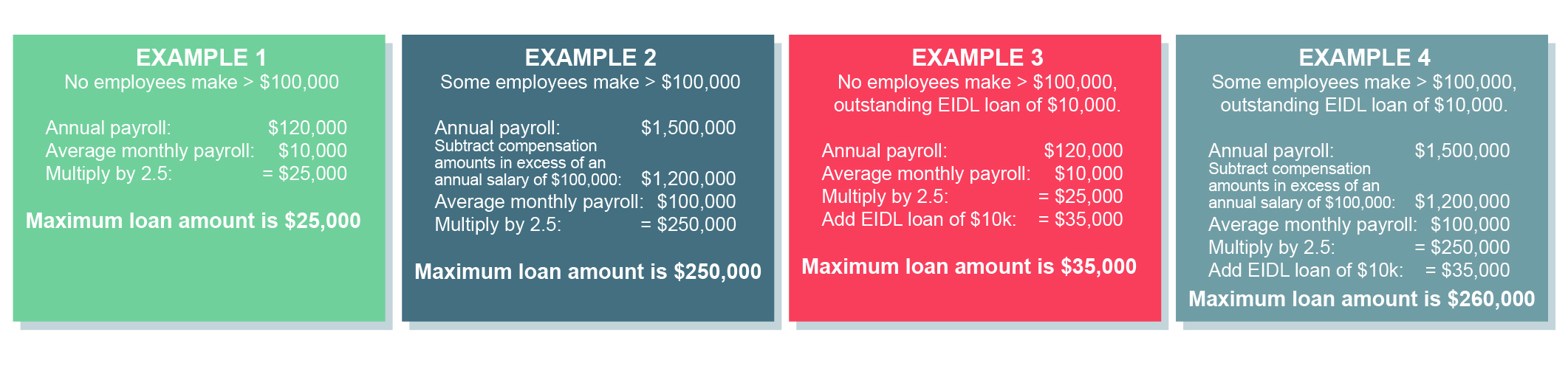

Loans can be up to 2.5 x the borrower’s average monthly payroll costs, not to exceed $10 million.

How do you calculate average monthly payroll costs?

Sum of INCLUDED payroll costs + Sum of EXCLUDED payroll costs = Payroll costs

Step 1: Aggregate payroll costs from the last twelve months for employees whose principal place of residence is the United States.

Step 2: Subtract any compensation paid to an employee in excess of an annual salary of $100,000 and/or any amounts paid to an independent contractor or sole proprietor in excess of $100,000 per year.

Step 3: Calculate average monthly payroll costs (divide the amount from Step 2 by 12).

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5.

Step 5: Add the outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020, less the amount of any “advance” under an EIDL COVID-19 loan (because it does not have to be repaid)

Sole proprietors, S-Corps, independent contractors and partnerships:

How you calculate your maximum loan amount depends upon whether or not you employ other individuals.

If you have no employees:

Step 1. Find your 2019 IRS Form 1040 Schedule C line 31 net profit amount (if you have not yet filed a 2019 return, fill it out and compute the value). If this amount is over $100,000, reduce it to $100,000. If this amount is zero or less, you are not eligible for a PPP loan.

Step 2. Calculate the average monthly net profit amount (divide the amount from Step 1 by 12).

Step 3. Multiply the average monthly net profit amount from Step 2 by 2.5.

Step 4. Add the outstanding amount of any Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020 that you seek to refinance, less the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid). Regardless of whether you have filed a 2019 tax return with the IRS, you must provide the 2019 Form 1040 Schedule C with your PPP loan application to substantiate the applied-for PPP loan amount and a 2019 IRS Form 1099-MISC detailing nonemployee compensation received (box 7), invoice, bank statement, or book of record that establishes you are self-employed. You must provide a 2020 invoice, bank statement, or book of record to establish you were in operation on or around February 15, 2020.

If you have employees:

Step 1. Compute 2019 payroll by adding the following:

a. Your 2019 Form 1040 Schedule C line 31 net profit amount (if you have not yet filed a 2019 return, fill it out and compute the value), up to $100,000 annualized, if this amount is over $100,000, reduce it to $100,000, if this amount is less than zero, set this amount at zero;

b. 2019 gross wages and tips paid to your employees whose principal place of residence is in the United States computed using 2019 IRS Form 941 Taxable Medicare wages & tips (line 5c- column 1) from each quarter plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips; subtract any amounts paid to any individual employee in excess of $100,000 annualized and any amounts paid to any employee whose principal place of residence is outside the United States; and

c. 2019 employer health insurance contributions (health insurance component of Form 1040 Schedule C line 14), retirement contributions (Form 1040 Schedule C line 19), and state and local taxes assessed on employee compensation (primarily under state laws commonly referred to as the State Unemployment Tax Act or SUTA from state quarterly wage reporting forms).

Step 2. Calculate the average monthly amount (divide the amount from Step 1 by 12).

Step 3. Multiply the average monthly amount from Step 2 by 2.5.

Step 4. Add the outstanding amount of any EIDL made between January 31, 2020 and April 3, 2020 that you seek to refinance, less the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid). You must supply your 2019 Form 1040 Schedule C, Form 941 (or other tax forms or equivalent payroll processor records containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or equivalent payroll processor records, along with evidence of any retirement and health insurance contributions, if applicable. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish you were in operation on February 15, 2020.

What qualifies as “payroll costs?”

Payroll costs consist of compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation; cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips); payment for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums, and retirement; payment of state and local taxes assessed on compensation of employees; and for an independent contractor or sole proprietor, wage, commissions, income, or net earnings from self-employment or similar compensation.

Is there anything that is expressly excluded from the definition of payroll costs?

Yes. The Act expressly excludes the following:

- Any compensation of an employee whose principal place of residence is outside of the United States;

- The compensation of an individual employee in excess of an annual salary of $100,000, prorated as necessary;

- Federal employment taxes imposed or withheld between February 15, 2020 and June 30, 2020, including the employee’s and employer’s share of FICA (Federal Insurance Contributions Act) and Railroad Retirement Act taxes, and income taxes required to be withheld from employees; and

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

Will this loan be forgiven?

Borrowers are eligible to have their loans forgiven.

How Much?

A borrower is eligible for loan forgiveness equal to the amount the borrower spent on the following items during the 8-week period beginning on the date of the origination of the loan:

- Payroll costs (using the same definition of payroll costs used to determine loan eligibility)

- Interest on the mortgage obligation incurred in the ordinary course of business

- Rent on a leasing agreement

- Payments on utilities (electricity, gas, water, transportation, telephone, or internet)

- For borrowers with tipped employees, additional wages paid to those employees

The loan forgiveness cannot exceed the principal.

How could the forgiveness be reduced?

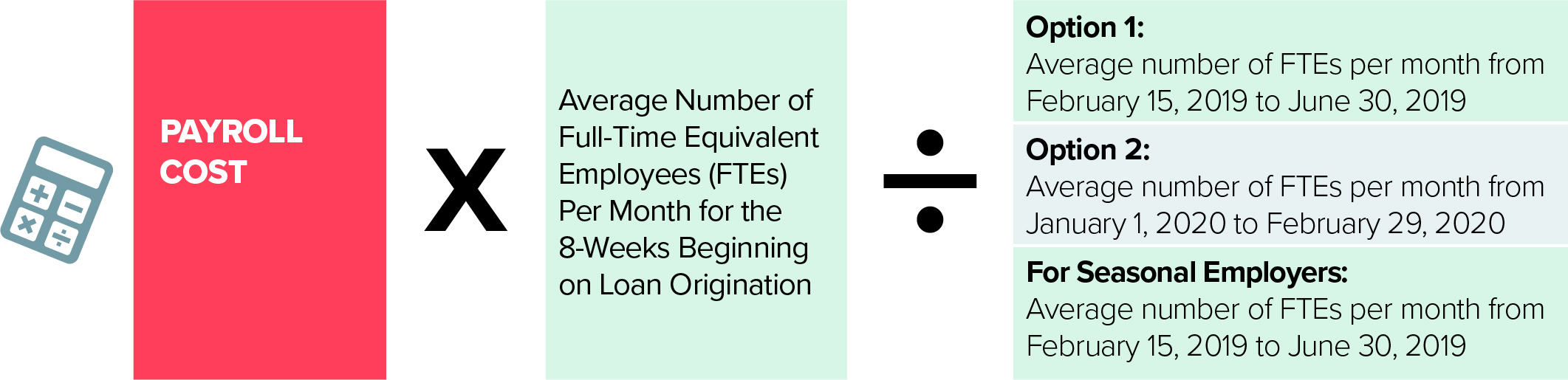

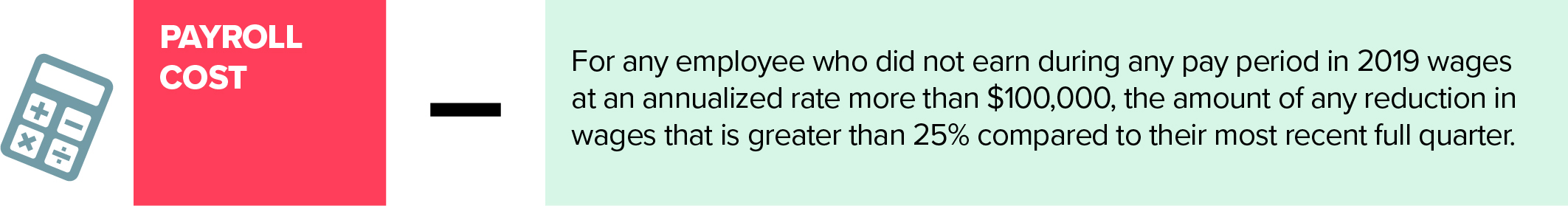

The amount of loan forgiveness calculated above is reduced if there is a reduction in the number of employees or a reduction of greater than 25% in wages paid to employees. Specifically:

Reduction based on reduction of number of employees

Reduction based on reduction in salaries

What if I bring back employees or restore wages?

Reductions in employment or wages that occur during the period beginning on February 15, 2020, and ending 30 days after enactment of the CARES Act, (as compared to February 15, 2020) shall not reduce the amount of loan forgiveness IF by June 30, 2020 the borrower eliminates the reduction in employees or reduction in wages.

Information about SBA Disaster Loans (EIDL)

Another option for small businesses is the Economic Injury Disaster Loan Program. This program is administered directly through the U.S. Small Business Administration (SBA) and offers low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of COVID-19. To apply for these loans and determine eligibility, visit https://disasterloan.sba.gov/ela/

Utah Leads Together Small Business Bridge Loan Program

The Utah Governor’s Office of Economic Development is offering a bridge loan to Utah-based small businesses with 50 or fewer employees impacted by the COVID-19 pandemic. Loan amounts range from $5,000 to $20,000 with 0% interest for up to a 60-month period. Loan amounts shall not exceed three months of demonstrated operating expenses. Loan payments are deferred for 12 months. GOED will use up to 25% of the funding for rural Utah businesses.

Visit the Utah Governor's Office of Economic Development web site at https://business.utah.gov/utah-leads-together-small-business-bridge-loan-program/ for details and an online application.

Thank you for your business. We will do our very best to assist you through these troubled times. Our thoughts are with you and your family, and we sincerely hope all are safe and healthy.