When you’re just starting out, you probably open a basic checking account to take care of your simple day-to-day financial needs. As your financial responsibilities and goals start to grow, however, you may find you want additional accounts — a savings account, an interest-earning checking account, or a Certificate of Deposit (CD).

If you’re considering opening an additional account, and you’re already a Bank of Utah customer*, we’ve made it even easier to open our featured digital accounts, using a shortened application within Online Banking. Rather than re-entering your basic information and identity information, you can skip straight to choosing how to make your first deposit. We’ve also made it so you can open these accounts jointly.

*If you have just opened your first bank account with Bank of Utah, you may not have the "Open an Account" feature set up in Online Banking just yet. Once you establish a pattern of regular account usage, this feature will be enabled for you.

How to Open a Featured Account in Online Banking

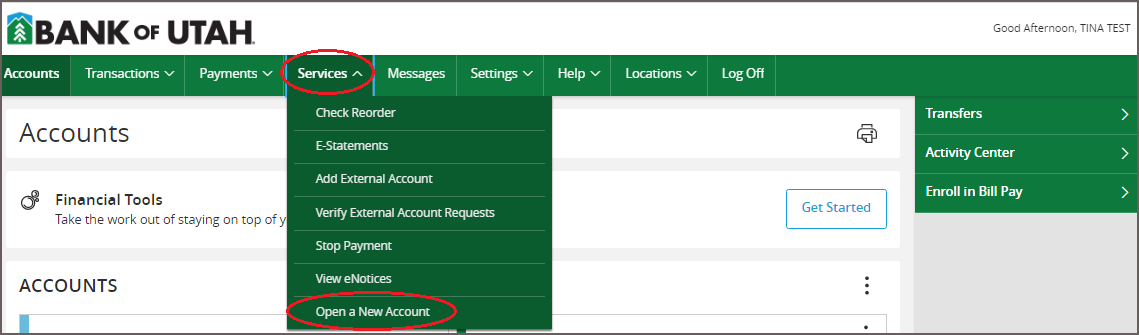

- Log in to Bank of Utah’s Online Banking platform using your existing username and password, or open your Bank of Utah Mobile App.

Click on the “Services” tab, the click “Open a New Account”.

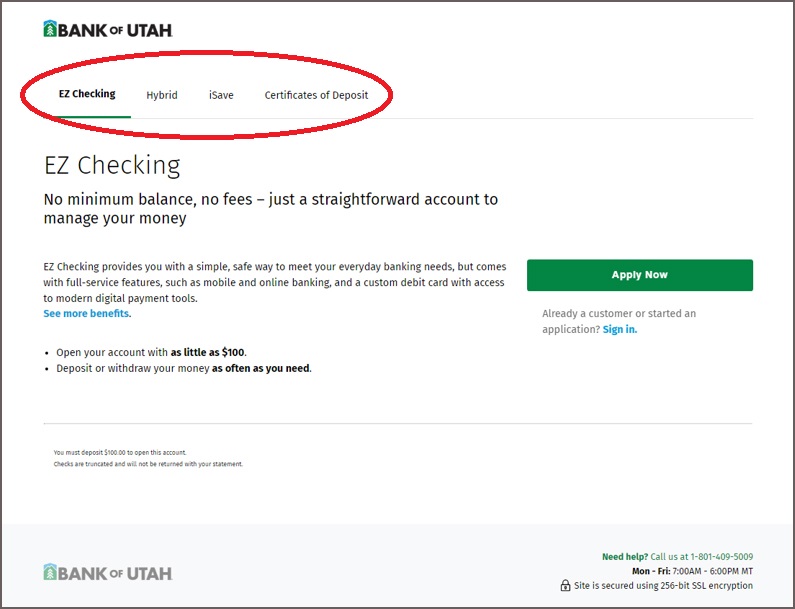

Select the account you’d like to open.

If you’d like to open the account jointly, click the appropriate box once you choose your account. At the end of the process, you’ll be prompted to enter the joint account holder’s email, and you’ll be able to start the application for them. They’ll need to check their email to verify they intended to open the account with you, and to finish their portion of the application.

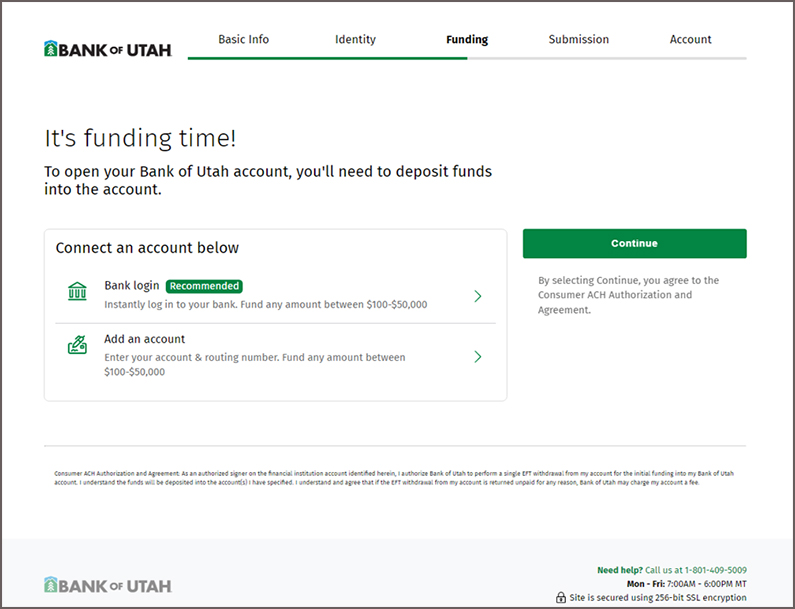

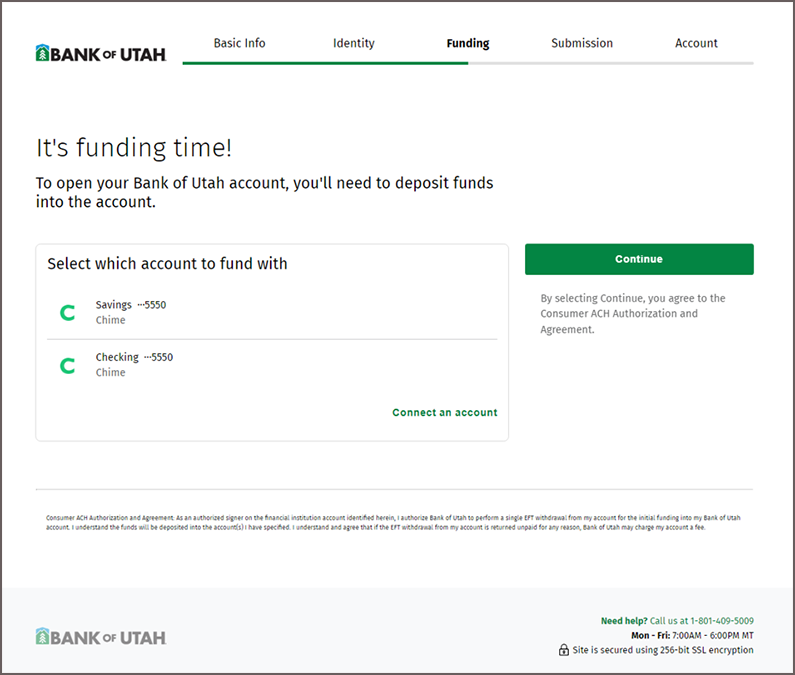

Select your funding method (how you choose to make your first deposit) and enter your funding amount.

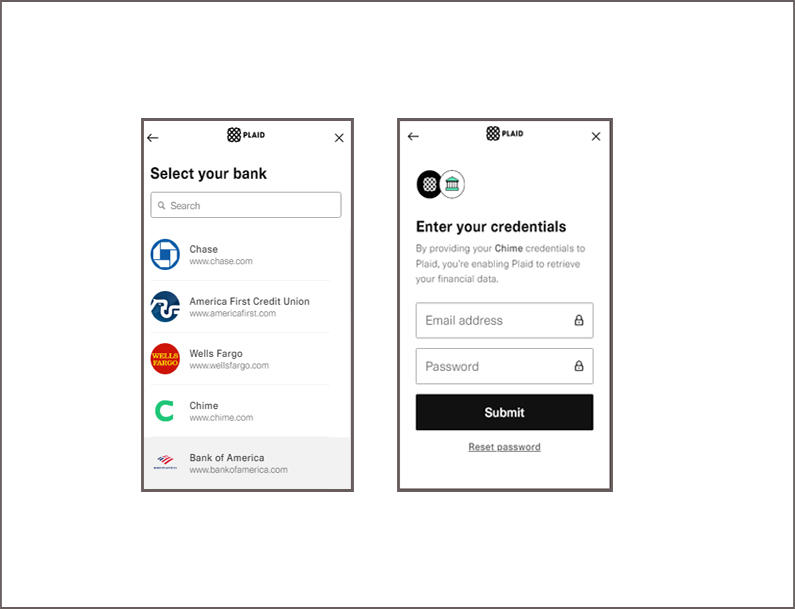

a. If you choose "Bank login," search for and select your bank, enter your credentials to access your accounts, then choose the one you'd like to fund from and enter your funding amount.

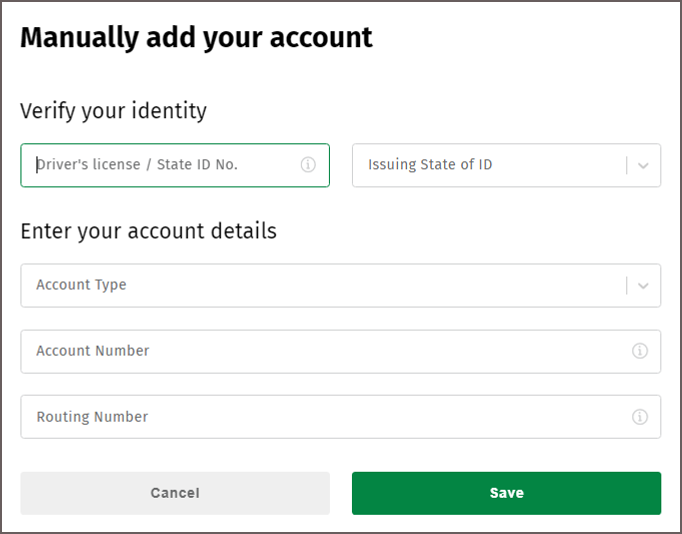

b. If you choose "Add an account," you'll enter your account and routing numbers from your financial institution, as well as the number/issuing state on your driver’s license or state ID.

c. If you’ve already opened an account online using “Bank login”, your previous funding method is saved and will appear. Simply select the account you’d like to fund from and enter your funding amount. If you’d like to fund from a different account, click “Connect an account” and follow the instructions.

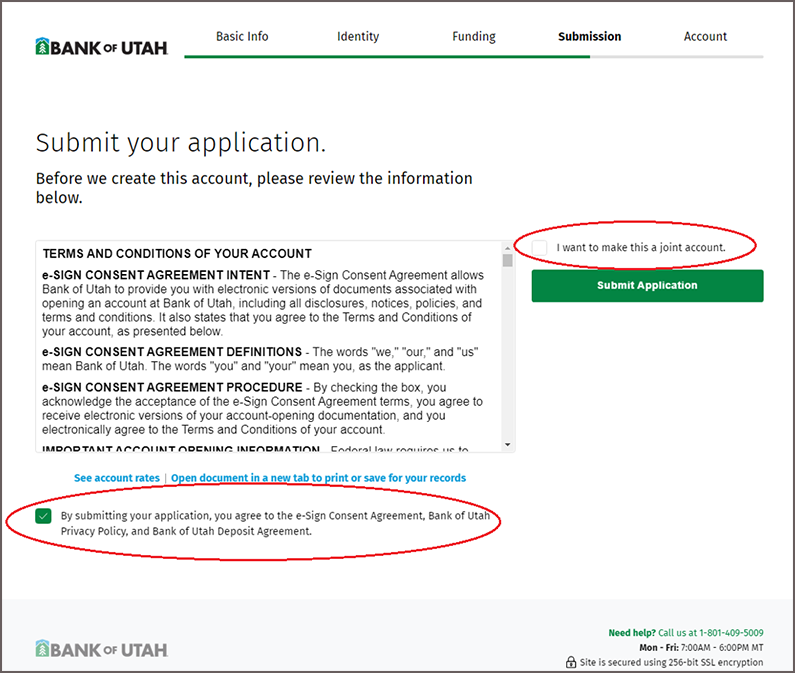

Read the terms and conditions of your account, and check the “eSign Consent Agreement”.

You can also choose to make the account a joint account on this page. Check the “I want to make this a joint account” box. You can then enter the email of the person you’d like to be the joint account holder, or you can start the application for them. (They will be emailed to verify they intended to be on the account, and to finish their portion of the application.)

- Hit “Submit Application”.

- On the next screen, be sure to read and select your options for a debit card, debit card overdraft protection and checks (depending on the checking account you've chosen). When you've made your selections, hit "Finalize your Account".

- You're done! On the last screen, you'll be prompted to sign up for Online Banking. Don't worry about that. Because you're an existing customer, we'll add your new account to Online Banking for you.