The adage, “Time is money,” is not new. Fun fact: It comes from a 1748 Benjamin Franklin essay titled “Advice to a Young Tradesman.” The $100 Founding Father simply meant that to get ahead, we must work and be productive, not idle.

Today that concept comes with a hefty dose of pressure, though, because somewhere in the last 273 years, an expectation was attached — that we should be doing double- or triple-time to maximize the money-to-time ratio. We’ve got the technology and tools to do more, so we should be able to, right?

I say let’s take the pressure off, in a way Benjamin Franklin would approve and in a way that helps us better focus on the things that matter most, such as our families, hobbies and activities. Let’s work on building good financial habits using technology to, ultimately, save us time and money.

One way is to use digital tools to manage your financial tasks. When you hear “Time is money,” you not only think about work, you most likely also think about getting paid. It’s worth considering that time should not just be applied to earning money but also to managing it. With the know-how and the right digital tools, you can follow good financial practices that will also lead to getting some precious time back in your life!

Get started with these 5 simple tips.

5 Tips for Using Technology to Manage Your Finances and Time

1. Spend time looking at your bank account activity.

Time commitment: little time/frequently

Designate 5 or 10 minutes every week or two to log in to your account online or through the mobile banking app. Look at the posted transactions. Are they what you expected? Are the amounts correct? This quick check will make sure everything has gone as planned in your account. It’s also the best, fastest way to spot signs of fraudulent charges. If you notice any transactions that shouldn’t be there, call the Bank right away.

We all spend at least 5 minutes a day digitally scrolling. Make your bank account a regular part of that scrolling routine, and you’ll get a good handle on your money.

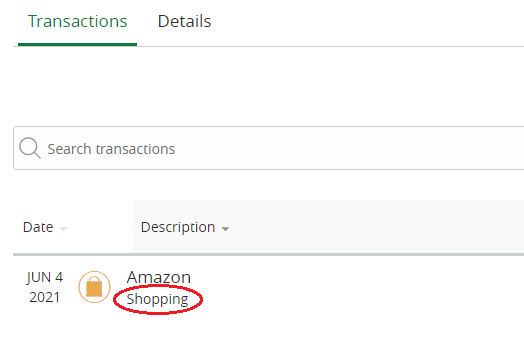

And while you’re logged in and reviewing transactions, go ahead and take a quick look at your transaction categories. Bank of Utah’s online banking system automatically assigns a category to each transaction. For example, in the image below you can see that it categorized an Amazon purchase as “Shopping.”

While technology is pretty smart, occasionally it can get it wrong or, in this case, it needs help being more specific. While yes, an Amazon purchase is "Shopping," the category could be more defined. It might be a gift, a product for the home, or something else. You can edit the category, and make it more precise, simply by clicking on the transaction, then clicking on “Category.” Updating the categories as you’re running down your list of debits and credits will make the next tip go even faster!

2. Look at budgets and trends.

Time commitment: 30–60 minutes/monthly

Dedicate time every month to understanding your spending/saving habits. Set a budget and monitor how well you stick to it month over month.

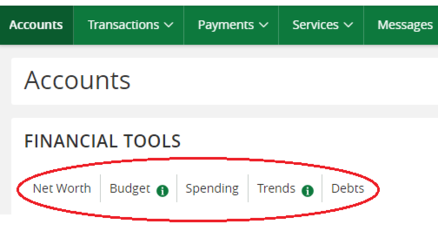

But, “Budgets are daunting!” you say. I hear you on that, but digital tools can give you more time to get smart on your spending, while spending less time plotting payments. Financial tools within Bank of Utah online banking and the mobile app can help you track your budget and watch your trends.

Remember in tip #1 where I talked about those budget categories? Here’s why they matter. The budget and trend tools automatically pull in all of your transactions, and based on the categories, will help you visualize how you’re spending and saving.

The budget tool will recommend a budget, or you can create your own. The trend tool gives you options to see how you’re doing in a 3-month, 6-month, 9-month or 1-year view, making it very easy to see when you spend more or less. The only caution is, make sure the categories attached to each transaction are accurate before you dive into learning from your spending habits (remember tip #1 again!).

Looking at your trends is helpful because some months are just more expensive than others. For example, we have a lot of family birthdays in October. Between festivities and gifts, October becomes a bigger spending month. As I’m watching my spending over time, I know that I typically have some money left over from my budget in September. I’ll know to spend even more conservatively that month so I can put any extra funds to good use the following month.

3. Set up ongoing savings transfers.

Time commitment: little time/once

Take a little time one evening to establish automatic savings transfers. You’ll thank yourself because you know saving money is important, but you also know that in today’s busy world, it’s easy to forget. After your initial setup within online banking or the mobile app, it’s hands-off the rest of the way, so you can sit back and watch your savings grow.

All you have to do is decide on an amount, schedule a recurring transfer, then your money will move from your checking account to your savings account like clockwork. You can make the transfers coincide with your paydays or happen on a set date.

Just think: $10 per pay period will net you $240 plus interest per year. That’s some good money saved, with little time or effort spent on your part, and you’ll never again have to say, ‘Oh no, I forgot to move money to my savings account!” You can rest assured the money has already been moved for you.

4. Use online/mobile banking to pay your bills.

Initial time commitment: some time/once, followed by very little to no time/monthly

Minimize the time it takes to pay your bills, using the bill pay feature within online banking and the mobile app.

The most time consuming part of this is the initial setup. Many companies are already featured within the bill pay database. Do a quick search, locate the company, and then all you need to add is your invoice or account number. If the company isn’t there, set them up using the information found on your bill (company name, address, phone number and your account information). Once that’s done, every time a bill comes due, you can pop into bill pay, enter the amount, confirm the amount and you’re done.

To make it even less time consuming, if you get recurring bills for a set amount, you can set up recurring payments. You choose when you want the payment to be delivered monthly, and how long you want the payment schedule to be followed, and then you don’t have to spend time paying bills. Simply follow tip #1 to watch your account activity, to ensure everything went as planned.

Bonus tip: You may be thinking, “I have recurring bills with utility companies that I’d love to auto pay, but the amount changes every month.” Some utilities will calculate an average of your usage for the past 12 months to create a set monthly payment for the next 12 months. Then you can budget for that amount accordingly. Call your utility company to see if that is something they can set up.

5. Pay friends and family with Zelle®.

Time commitment: very little time/as needed

Enjoy spending time with your friends and family, not rushing around to get cash!

We’ve all had the experience of going in on a joint gift with a group. Then comes the hassle of paying back the person who purchased the gift. You have to run to the ATM or look for that $10 bill you stashed in a safe place for just this type of situation. Who carries cash consistently? Use Zelle instead to transfer money electronically from your bank account to your family or friend’s bank. Found within online banking or the mobile app, Zelle is convenient, easy to use and secure.

Combine These Habits and Tools to Save Time and Money!

You’ve invested a lot of time and hard work earning your money. It’s important to create good habits for managing it – that’s how you maximize your money. It’s also important to use the digital financial tools that are available to you these days – that’s how you maximize your time.

And remember, while Benjamin Franklin coined “Time is money,” he is also credited with saying, “Employ your time well, if you mean to get leisure.” By adopting the practices mentioned above, you’ll be able to manage your money wisely, while saving yourself time and stress!

Mary McBride is Vice President of Digital Experience and Sales at Bank of Utah. She loves finding ways to ensure the Bank’s digital channels give customers the information, tools and resources they need. Mary is a mother of two who loves exploring the trails in our great state with her husband and kids.

Mary McBride is Vice President of Digital Experience and Sales at Bank of Utah. She loves finding ways to ensure the Bank’s digital channels give customers the information, tools and resources they need. Mary is a mother of two who loves exploring the trails in our great state with her husband and kids.